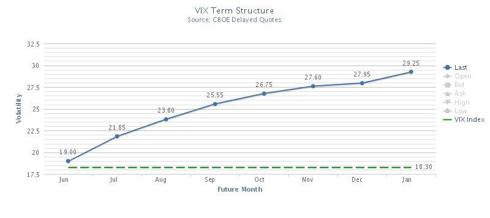

Contango is Back

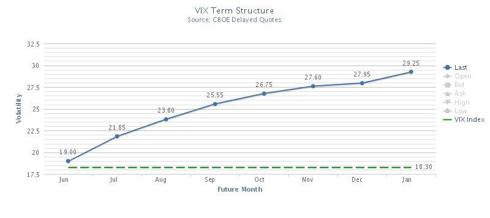

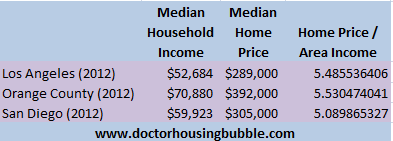

The volatility futures curve is back in strong contango, and with it an opportunity to profit from the short trade on volatility linked ETFs/ETNs. For a primer on this trade, see previous articles

here and

here, but in short it's an attempt to profit from the bias of investors to believe that market volatility in the future will be greater than it is in the present - essentially a fear of the "unknown unknowns".

(click to enlarge)

Current contango of 15% (as of 6/18/12) is very steep even by standards of the VIX futures curve norms, and is steeper than it has been at any point since March 2012 and before that in April of 2011. There are many reasons to be uncertain about risk in the markets at current, but it's questionable at best to believe that there will be more reasons to be concerned in August than in July, which is what futures traders are expressing.

A Better Way to Play

In the past, I have advocated the use of short (

VXX) or long (

XIV) as ways to profit from steep contango, but there is, in my opinion, a more compelling way to profit from contango, short (

TVIX).

is a 2x leveraged version of the VXX which should, in theory, return 2x the daily gains or losses of VXX or similarly structured funds.

However, as many have

observed the TVIX had a pretty wild ride this spring. For those not familiar with the fund, in February the fund's sponsor Credit Suisse

temporarily halted creation of new units of the fund in response to skyrocketing demand and ballooning risk exposure for CS. Halting the issuance of new shares broke the mechanism that tends to keep funds trading in line with underlying value, and in a tulip mania moment, the market bid the price up to an 89% premium to fair value in just a few weeks. About a month later, when the sponsor resumed issuing shares on a limited basis, shares traded down sharply and more in line with fair value

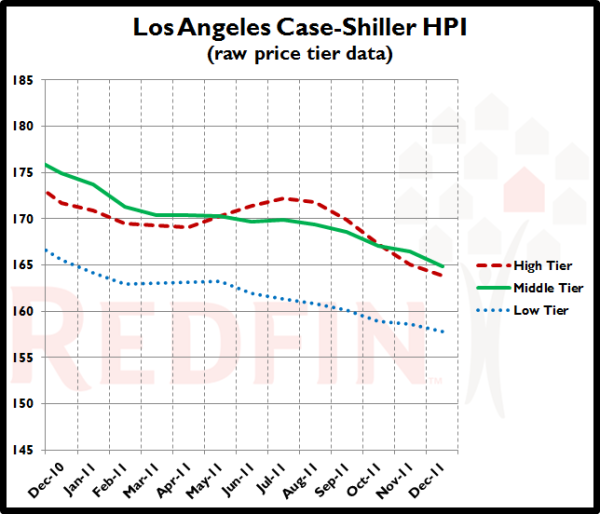

However, "more in line" is not the same as "in line". In the approximately three months since CS resumed share issuance, the relative premium (discount) to fair value of TVIX trading has ranged from a 17% premium to a 2% discount vs. net asset value so the current +21% is outside the high end of that range. The below chart illustrates the premium to fair value since late March.

(click to enlarge)

It's worth noting that the compression of premium has tended to happen by the mechanism of TVIX market price rising much less than would be implied by changes in the underlying value, rather than any outright selling off. For instance, in the period from May 10th to May 18th, when the underlying index that TVIX is based on rose by 79% the share price rose only 57% and the 12% premium vanished. Similarly on May 30th when the underlying index rose 21% in one day the TVIX rose only 10%. By way of analogy, the casino has started paying blackjacks at 6:5 instead of 3:2. You can still profit from the long side, just like a lucky blackjack player can make money on a blackjack table that pays 6:5, but the smart player stays away.

Catalyst for Change

It seems reasonable that the current regime of 5-15% premiums will continue until either (1) leveraged ETF speculators become rational, or (2) Credit Suisse fully opens the window to "authorized participants" that are able to buy shares at net asset value and sell at market price, for a fast and virtually risk free profit. Since I have zero expectation of the former, the reversion trade hinges largely on timing of the latter.

Specialists/authorized participants would jump at the chance to buy at indicative value and sell at market, so the key decision-maker here is the risk management folks at Credit Suisse that decided to tap the brakes back in February as they watched their market exposure grow exponentially.

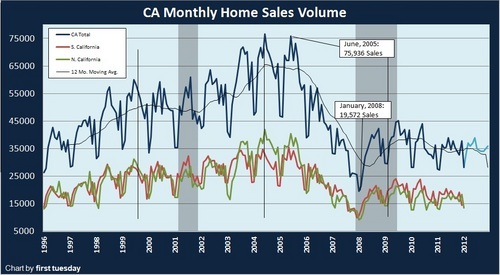

The below chart shows the total potential market exposure for CS to the TVIX, assuming they are not hedging away any of their risk by trading on the futures market (if they're hedging, it would be less than shown). Prior to February 2012, CS exposure to the TVIX remained between $100M and $300M, as calculated from:

number of shares outstanding * indicative asset value

(click to enlarge)

Note that the current market exposure of $278M (52.4M shares at $5.31 each) takes risk back to where it was in late January, before the trip to crazy-town that spooked the risk management folks. If the short term volatility index on which TVIX is based continues to fall, this number will get lower and we may see further share creation that leads to selling pressure as the lucky specialists cash in their golden ticket.

Warning - Not a Risk Free Arbitrage

It's worth reiterating that the short TVIX trade is not a risk free arbitrage, simply a favorable risk/reward tradeoff. If volatility does spike as it most certainly can do, TVIX will spike as well - and the rising value of the CS exposure would make new share creation less likely. If it falls, however, longs in the fund may become impatient, and Credit Suisse may become bolder about putting more shares on the market.

Anyone taking a position would be wise to recognize that this is a leveraged ETN tracking volatility which is traded by irrational speculators and size positions accordingly.

Disclosure: I am short

TVIX.