Showing posts with label stock market. Show all posts

Showing posts with label stock market. Show all posts

Thursday, August 16, 2012

Friday, August 3, 2012

Past short Idea

http://screencast.com/t/sOp0wjUcu2RD

OPEN last year would given me a lot of money. The point is why we miss opportunities like this. Need to be patient at the same time understand the Earning and technical analysis and patience.

Study the past graphs . very important

OPEN last year would given me a lot of money. The point is why we miss opportunities like this. Need to be patient at the same time understand the Earning and technical analysis and patience.

Study the past graphs . very important

Have to try our something a little different

I need to use the money more efficiently and wisely. My main problem has been putting large amounts of money in the stocks that move in the wrong direction.

There is a rule that says When in uncertainty cut your position. Especially if the stock is showing strong RS in the case of shorting.

Start with a small position in uncertain position or better do not enter the position.

There are plenty of opportunities in the market. I almost make 20 percent in ARNA but there was not much money invested in it. This is a problem because cash was stuck with other stocks. I need to have cash available when I need it.

This diversification is not a good strategy. It is good to put money where you are making money. Do not buy more unless the stock moves in you direction or you are super confident technically.

I have to put my money where I can get money. I have to choose the best stocks instead of jumping around and losing money.

There is a rule that says When in uncertainty cut your position. Especially if the stock is showing strong RS in the case of shorting.

Start with a small position in uncertain position or better do not enter the position.

There are plenty of opportunities in the market. I almost make 20 percent in ARNA but there was not much money invested in it. This is a problem because cash was stuck with other stocks. I need to have cash available when I need it.

This diversification is not a good strategy. It is good to put money where you are making money. Do not buy more unless the stock moves in you direction or you are super confident technically.

I have to put my money where I can get money. I have to choose the best stocks instead of jumping around and losing money.

Thursday, August 2, 2012

flop show with KCG

There was no need to touch this stock. It just got out of hand and there was not even a stop loss. Wow!!

Bad trade. The market did what it did. Never buy a stock going down. I broke the rule and it burnt. It was a stupid mistake.

http://screencast.com/t/j01vuvPggI

I was deceived by the early spike in price to 4.30 cents. That was obviously the shorts covering in the morning. When a stock falls this big like 50 percent don't you think some shorts are going to cover and there is going to be a initial price jump???

What a stupid mistake.

I should have just stayed with ARNA where I made good money.

Bad trade. The market did what it did. Never buy a stock going down. I broke the rule and it burnt. It was a stupid mistake.

http://screencast.com/t/j01vuvPggI

I was deceived by the early spike in price to 4.30 cents. That was obviously the shorts covering in the morning. When a stock falls this big like 50 percent don't you think some shorts are going to cover and there is going to be a initial price jump???

What a stupid mistake.

I should have just stayed with ARNA where I made good money.

Friday, July 20, 2012

The Safest And Easiest Way To Generate 250% Gains

http://seekingalpha.com/article/726811-the-safest-and-easiest-way-to-generate-250-gains?source=kizur

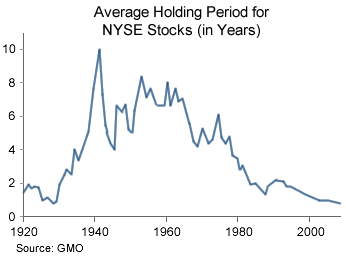

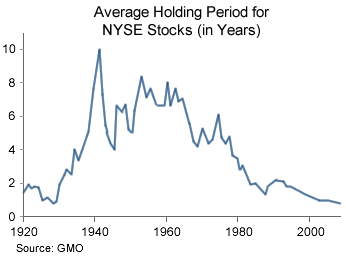

There is a troubling trend among U.S. investors, and it's causing them to miss out on millions of dollars of potential profits.

In the past 50 years, the average holding period for stocks has dwindled from eight years to just eight months.

There's no doubt that lower average has been affected by the rise of computer-based high-frequency trading.

But it has also been affected by the rise of individual investors and online brokers. Decades ago, few people had a brokerage account. And buying or selling a stock meant visiting or calling a stockbroker.

hese brokers typically charged high commissions of $40... $80... even several hundred dollars or more. Today, most trades are made with a click of a mouse and for no more than $10 in commissions.

Combine that ease of trading in and out of stocks with the market's volatility and you have the perfect recipe for something that has proven disastrous for most small investors -- they are now holding their shares for unbelievably short periods of time.

The problem with this trend is that it's hurting how much money investors make in the stock market.

Consider this...

I recently ran a simple stock screen on my research team's Bloomberg terminal. I asked this piece of research software to show me all the stocks in the United States that have returned more than 250% in the past year. And to weed out the fly-by-night penny stocks, I had it return only stocks with market caps above $250 million that traded on a major exchange.

The result? Just five stocks -- five out of a total universe of 3,258 companies -- have gained more than 250% in the past year. That's the definition of trying to find a needle in a haystack.

There is a troubling trend among U.S. investors, and it's causing them to miss out on millions of dollars of potential profits.

In the past 50 years, the average holding period for stocks has dwindled from eight years to just eight months.

There's no doubt that lower average has been affected by the rise of computer-based high-frequency trading.

But it has also been affected by the rise of individual investors and online brokers. Decades ago, few people had a brokerage account. And buying or selling a stock meant visiting or calling a stockbroker.

hese brokers typically charged high commissions of $40... $80... even several hundred dollars or more. Today, most trades are made with a click of a mouse and for no more than $10 in commissions.

Combine that ease of trading in and out of stocks with the market's volatility and you have the perfect recipe for something that has proven disastrous for most small investors -- they are now holding their shares for unbelievably short periods of time.

The problem with this trend is that it's hurting how much money investors make in the stock market.

Consider this...

I recently ran a simple stock screen on my research team's Bloomberg terminal. I asked this piece of research software to show me all the stocks in the United States that have returned more than 250% in the past year. And to weed out the fly-by-night penny stocks, I had it return only stocks with market caps above $250 million that traded on a major exchange.

The result? Just five stocks -- five out of a total universe of 3,258 companies -- have gained more than 250% in the past year. That's the definition of trying to find a needle in a haystack.

Tuesday, June 26, 2012

One thing common in all good stocks

All the stocks that went up including Apple, Autozone, Ross, dollar tree, Master card, visa, discover card, etc...the earning per share,EPS is high.

These were good stocks to buy and leave for 1 year and one would see 50 to 100 profit margin. The basic buffet rules to buy stocks.

These were good stocks to buy and leave for 1 year and one would see 50 to 100 profit margin. The basic buffet rules to buy stocks.

Sunday, October 2, 2011

Quote of the day: Buy and Hold edition

Quote of the Day: Buy and Hold Edition

Edwin LeFebvre: Reminiscences of a Stock Operator:

Men who can both be right and sit tight are uncommon. I found it one of the hardest things to learn. But it is only after a stock operator has firmly grasped this that he can make big money. It is literally true that millions come easier to a trader after he knows how to trade than hundreds did in the days of his ignorance…

Wednesday, May 18, 2011

Important observation*************

It is during mid day, that stock are in the extremes mostly. If it is a selling day, the stocks are at usually at the bottom at around 10.30-11.30 pacific time. If it is the buying day, stocks are at the peak at this time.

this observation is very important for day trading. I think I should wait till the mid day either to make sell or short or buy and hold decision.

This observation is after looking at charts every day from several months. To get maximum profit out of deals, do not trade till the mid day.

this observation is very important for day trading. I think I should wait till the mid day either to make sell or short or buy and hold decision.

This observation is after looking at charts every day from several months. To get maximum profit out of deals, do not trade till the mid day.

Wednesday, May 11, 2011

What do day traders do with volatile stocks

| Print chart | |

On Google maps, when you use 30,2m moving average its basically a 2 month moving average for day trading, it is very helpful.

There was heavy selling at 12.30 pm. All the time the stock was below the moving average. If the stock is below it do not buy back shares in case you are shorting. I made that mistake today. Because other day traders short stock like these that are depressed by

5-10 percent and make money and then cover the shorts at day end. This is when the stock goes down and the reverse is true for stock that go up.

The lowest point was at 12.30 pm. Then the stock crossed the 2 month MA. This is the time to buy back shares and retain maximum profit. Also observe the high volume during that mid day time. Interesting.

When you see at stock depress and elevated by 5-10 percent, these are the stock for day trading safely and make a profit of 3 percent. If one is good at day trading and using moving average , then one can do this. One can hold stock long or short for longer time with half the portfolio and for fun also do some day trading.

AG technical analysis

| Print chart | |||||||||||

Made some money off this stock. I should have waited. Since the major sell off happened from 18.50 to 17.75. Within a span of 20 minutes when I went to take my dog for a walk.

At some point one has to cover one's position. Not a bad job. Stock market has great potential if done properly and following the rules and then having patience to realize one's knowledge.

Good day for me. This stock may fall further but I lowered my bet and risk. I can do day trader with lesser amount if necessary. Since, I have learnt how to do day trading, it has become an asset. Do not have to hold when risk of holding overnight is high or unpredictable.

Day trading is much better in such situation.

Also made money by shorting URI and NOG by day trading.

Tuesday, May 10, 2011

AG technical analysis

| Print chart | ||||||||||||

| 1d | 5d | 10d | 1m | 3m | 6m | YTD | 1yr | 3yr | 5yr | 10yr | Max |

Stock moving below the 30 MA, Shorted at 19.5. 3rd day of moving up after the fall. Stocks may move upto 4 days towards the 30 MA. Then slowly come down the way it went up. Have to wait for another couple of days for complete action.

Same thing happened with NOG.

As Jessie would say, I put all money at 23. Stock went up till 25. should have waited. But did not. Took a small lose and got out. But stock slided to 20 now. Should have got stocks in 40, 40, 20 percent succession. Do not put all your money at the same time at buying. This is the reason, I am getting loss, even though I am correct in my analysis. If stock moves against you, then one panics for even a minor change and sells.

That is the reason why to have at least 3 stocks in portfolio to play with.

Intraday Fosl

| Print chart | |||||||||||||

Opened at 101. High volume buying in the 1 hr. Stock moved to 113. High 107. Stock stable rest of the day. Probably ends today at around 102-104.

Good stock to play the intraday today. But no money today ;) Also a good stock for buying call options. If stock consolidates, then its good time to buy call options.

Saturday, May 7, 2011

Buying like Jesse Livermore

There is a lesson I need to learn, that I realized today. Most of the losses I got , which I later covered were due to going full money into trades that did not go in the direction I wanted. Like buying ENDP at 43 with more than 70-80 percent of money. This also happened with other stocks. This is a major mistake I am making.

As Jesse advises, buy in portions. Do not worry of the meager cost of each trade compared to the loss you get overall price of each trade is nothing. Buy in portions like if you want to buy 1000 stocks, buy 200, 200, 200 and 400. If they are on the rise buy accordingly.

If you are in full position in any stock you are in a danger situation. Your capital is at high risk.

In case of day trading, get into stock that are volatile in the range of 5-18 percent. Even if you get into it with high leverage get out of the trade with profits in the range of 3-4 percent and cover position for the day.

Use half the money in the account for long trend stocks. Use half for day trading. This the perfect mix. Then you do not have to keep selling your good stocks to do day trading. Cover your day trading by the end of the day unless it is an exceptional case.

Understand the psychology of each stock trend. Understand what others are doing. You are not alone trading. There are other people sitting in front of computer like you trying to make money in the market. Understand herd psychology. What others are doing and go long or short according to that.

As Jesse advises, buy in portions. Do not worry of the meager cost of each trade compared to the loss you get overall price of each trade is nothing. Buy in portions like if you want to buy 1000 stocks, buy 200, 200, 200 and 400. If they are on the rise buy accordingly.

If you are in full position in any stock you are in a danger situation. Your capital is at high risk.

In case of day trading, get into stock that are volatile in the range of 5-18 percent. Even if you get into it with high leverage get out of the trade with profits in the range of 3-4 percent and cover position for the day.

Use half the money in the account for long trend stocks. Use half for day trading. This the perfect mix. Then you do not have to keep selling your good stocks to do day trading. Cover your day trading by the end of the day unless it is an exceptional case.

Understand the psychology of each stock trend. Understand what others are doing. You are not alone trading. There are other people sitting in front of computer like you trying to make money in the market. Understand herd psychology. What others are doing and go long or short according to that.

Trading rules from several books

This book clearly explains 12 habits you must develop to be a successful trader. These habits are developed through having the right attitude toward trading.

Preparedness-You must be prepared to trade, do not take trades with out the right thought put into the trade and methods applied to them.

Abundance consciousness-You must believe that there is plenty of money to be made in the markets, and you deserve to have your share.

Risk Taking-You have to take the right amount of risk for your profit goals but not put yourself in a situation of blowing up your account.

Thinking in Probabilities-You must trade in a way that gives you an edge in the markets. The odds should be in your favor.

Discipline-You must follow your own methods and strategies that give you that edge. Always follow proper psychology, risk management, and method.

Courage- You must have the ability to pull the trigger and make the trade. You can't paper trade and back test systems forever.

Accept Loss-This is the most important habitude, you must decide what price will let you know you are wrong and sell to stop your losses when that price is hit. Not doing this can lead to the destruction of your account.

Comfortable with Uncertainty-You must understand that anything can happen at any time in the markets, and accept that.

Optimism-You must have a positive attitude when trading.

Open-Mindedness-You must be open to all possibilities, and be able to change styles and systems when markets change.

Long Term View-You have to understand that each trade is only one among hundreds

and that in the long term your systems and methods will be successful and you will profit even after draw downs in equity.

Detachment-You must keep your self worth and ego separated from your trading. You are not your trades. You will trade better if your life is balanced.

Preparedness-You must be prepared to trade, do not take trades with out the right thought put into the trade and methods applied to them.

Abundance consciousness-You must believe that there is plenty of money to be made in the markets, and you deserve to have your share.

Risk Taking-You have to take the right amount of risk for your profit goals but not put yourself in a situation of blowing up your account.

Thinking in Probabilities-You must trade in a way that gives you an edge in the markets. The odds should be in your favor.

Discipline-You must follow your own methods and strategies that give you that edge. Always follow proper psychology, risk management, and method.

Courage- You must have the ability to pull the trigger and make the trade. You can't paper trade and back test systems forever.

Accept Loss-This is the most important habitude, you must decide what price will let you know you are wrong and sell to stop your losses when that price is hit. Not doing this can lead to the destruction of your account.

Comfortable with Uncertainty-You must understand that anything can happen at any time in the markets, and accept that.

Optimism-You must have a positive attitude when trading.

Open-Mindedness-You must be open to all possibilities, and be able to change styles and systems when markets change.

Long Term View-You have to understand that each trade is only one among hundreds

and that in the long term your systems and methods will be successful and you will profit even after draw downs in equity.

Detachment-You must keep your self worth and ego separated from your trading. You are not your trades. You will trade better if your life is balanced.

Friday, May 6, 2011

JOBS,OPEN,PPO day trading analysis

| Print chart | |||||||||||||

The day begins with heavy buying and high volume. this is due to day trader activity. I cannot draw a 30 day, 2 month base line but it once it crosses that line at the top end around 64, it stays there for the rest of the day.

One important thing is the consolidation phase in day trading. around 60, 62 and then peaks at 64.

I observed that it is sometimes when the opens high at the opening, but it may come down from there. If the stock crosses the

2 month average which can be drawn in google finance, then one has to get out of the trade. If consolidation above it that is the time to buy. Need more study on this topic.

| Print chart | ||||||||||||

Opened with 10 percent gain, then heavy buying during the opening hours brought the stock to 18 percent high. Usually the day traders cover at the day end.

| Print chart | ||||||||||||

5 day chart of OPEN

This is the reverse of the above. Here the stock fell from the 30 MA after phase 3 and entered phase 4. Heavy selling at the day opening. The short cover their position at the end of the day. So the stock goes steep down during mid day due to shorting activity during day trading, then the storts cover the end of the day and the losses cover.

All these stocks range from 10-20 percent movement. These are the kind of stocks I need to study and day trade if I need to to get around 3-4 percent profit a day. One should not be too greedy. One should get out with 3-4 percent profit and be satisfied.

And cash out a check.

Day trading with too much speculative stock in the range of 20-40 percent can be dangerous. But going by the 2 month graph it is still possible but one has to get out if one buy at a wrong point. Or buy during consolidation. I need to more study on this topic. But the rules are the same for the day trading or for longer holding, and going by trend analysis.

Thursday, May 5, 2011

Day trading

I am able to understand a lot about day trading and the volatility we see in stocks during the day. Most of it is because of professional day traders who buy on a rising stocks in the morning and afternoon and cover during the day closes.

There are ups and downs to doing day trading. But one has to day trade only on volatile stocks in the range of 2-20 percent. One can gain 3-4 percent on a daily basis.

Suppose a stock goes up 10 percent after opening it can go up to 20 percent or go down to 5 percent.

It is important to use limits during day trade.

Suppose a stock goes up then has a pull back of 2-3 percent. that is the time to purchase. But if the pull back is more 2-3 percent after you buy, than you got to sell it. Usually on rising stock, after the pull back of 2-3 percent, the stock moves to it 2-5 percent if more buying ensues.

Same thing during shorting too, when stock moves up or down with high volume there is high volatility. These are the stocks to get into for day trading. These kind of stocks you can make 2-5 percent on a single day trade. The most important thing is to understand the upside or down side trend of the stock. Ofcourse, the extreme cases, are the best to deal with.

1. If a stock when up 25-45 percent above 30 day moving average. One should see evidence of moving down and should not guess the day before for day trading. If you see a high volume of up or down, then you get into the trade and take a profit of 3 percent and get out every day.

It is possible and interesting strategy. today PPO went from 10 percent in the opening to 21 percent. But it may come down to 15 percent when closing because the day traders will cover positions and take profits.

All this volatility is because of them. Very interesting point and observation about psychology of trading.

There are ups and downs to doing day trading. But one has to day trade only on volatile stocks in the range of 2-20 percent. One can gain 3-4 percent on a daily basis.

Suppose a stock goes up 10 percent after opening it can go up to 20 percent or go down to 5 percent.

It is important to use limits during day trade.

Suppose a stock goes up then has a pull back of 2-3 percent. that is the time to purchase. But if the pull back is more 2-3 percent after you buy, than you got to sell it. Usually on rising stock, after the pull back of 2-3 percent, the stock moves to it 2-5 percent if more buying ensues.

Same thing during shorting too, when stock moves up or down with high volume there is high volatility. These are the stocks to get into for day trading. These kind of stocks you can make 2-5 percent on a single day trade. The most important thing is to understand the upside or down side trend of the stock. Ofcourse, the extreme cases, are the best to deal with.

1. If a stock when up 25-45 percent above 30 day moving average. One should see evidence of moving down and should not guess the day before for day trading. If you see a high volume of up or down, then you get into the trade and take a profit of 3 percent and get out every day.

It is possible and interesting strategy. today PPO went from 10 percent in the opening to 21 percent. But it may come down to 15 percent when closing because the day traders will cover positions and take profits.

All this volatility is because of them. Very interesting point and observation about psychology of trading.

NOG SHORTING

| Print chart | ||||||||||||

i shorted at 23 when the stock was rising up towards the 30 day MA. When ever you see a big spike towards the 30 day moving average when the stock is moving downward, that is the time to short the stock. At the top or when it is moving down,.

As the law of probability, stocks coming down go down for more than one day. May be 2-3 days. Then one day up. But in this case of big spike it went up 4 days towards the 30 MA. That is the best time to short. It went up to 25. Now it is at 20. It was a solid 20 percent profit if done in the right way.

Another missed oppurtunity.

Wednesday, May 4, 2011

Shorting Time...many stocks tumbling from tops

Many stocks are starting to tumble from their highs. Look at stage 4 stocks in portfolio.

One needs to wait for a couple of weeks to see some good profits.

One needs to wait for a couple of weeks to see some good profits.

Tuesday, May 3, 2011

Daily analysis CTSH

CTSH slipped 8.5 percent. Looks like a Top head and shoulder. I stock is at its 52 week high. Back in 2007, this stock went up and came down. But it had those peaks touching the 30 MA while coming down. This stock goes down but comes up too. One can take advantage of this property.

But definitely on the top now. NOT A HOLD STOCK. good for day trading. Expecting it to up to 79 then will sell off.

There is a correction in this stock. Many stocks at 52 week highs. This stocks came down the 30 MA with heavy volume. Definitely not a hold stock. Just cash out and get out.

But definitely on the top now. NOT A HOLD STOCK. good for day trading. Expecting it to up to 79 then will sell off.

There is a correction in this stock. Many stocks at 52 week highs. This stocks came down the 30 MA with heavy volume. Definitely not a hold stock. Just cash out and get out.

Subscribe to:

Posts (Atom)