http://seekingalpha.com/article/726811-the-safest-and-easiest-way-to-generate-250-gains?source=kizur

There is a troubling trend among U.S. investors, and it's causing them to miss out on millions of dollars of potential profits.

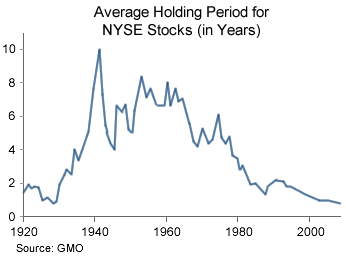

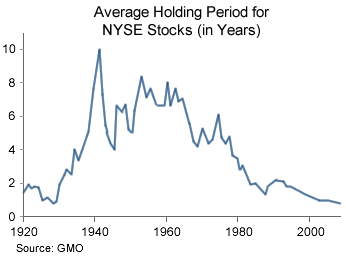

In the past 50 years, the average holding period for stocks has dwindled from eight years to just eight months.

There's no doubt that lower average has been affected by the rise of computer-based high-frequency trading.

But it has also been affected by the rise of individual investors and online brokers. Decades ago, few people had a brokerage account. And buying or selling a stock meant visiting or calling a stockbroker.

hese brokers typically charged high commissions of $40... $80... even several hundred dollars or more. Today, most trades are made with a click of a mouse and for no more than $10 in commissions.

Combine that ease of trading in and out of stocks with the market's volatility and you have the perfect recipe for something that has proven disastrous for most small investors -- they are now holding their shares for unbelievably short periods of time.

The problem with this trend is that it's hurting how much money investors make in the stock market.

Consider this...

I recently ran a simple stock screen on my research team's Bloomberg terminal. I asked this piece of research software to show me all the stocks in the United States that have returned more than 250% in the past year. And to weed out the fly-by-night penny stocks, I had it return only stocks with market caps above $250 million that traded on a major exchange.

The result? Just five stocks -- five out of a total universe of 3,258 companies -- have gained more than 250% in the past year. That's the definition of trying to find a needle in a haystack.

There is a troubling trend among U.S. investors, and it's causing them to miss out on millions of dollars of potential profits.

In the past 50 years, the average holding period for stocks has dwindled from eight years to just eight months.

There's no doubt that lower average has been affected by the rise of computer-based high-frequency trading.

But it has also been affected by the rise of individual investors and online brokers. Decades ago, few people had a brokerage account. And buying or selling a stock meant visiting or calling a stockbroker.

hese brokers typically charged high commissions of $40... $80... even several hundred dollars or more. Today, most trades are made with a click of a mouse and for no more than $10 in commissions.

Combine that ease of trading in and out of stocks with the market's volatility and you have the perfect recipe for something that has proven disastrous for most small investors -- they are now holding their shares for unbelievably short periods of time.

The problem with this trend is that it's hurting how much money investors make in the stock market.

Consider this...

I recently ran a simple stock screen on my research team's Bloomberg terminal. I asked this piece of research software to show me all the stocks in the United States that have returned more than 250% in the past year. And to weed out the fly-by-night penny stocks, I had it return only stocks with market caps above $250 million that traded on a major exchange.

The result? Just five stocks -- five out of a total universe of 3,258 companies -- have gained more than 250% in the past year. That's the definition of trying to find a needle in a haystack.

No comments:

Post a Comment