http://screencast.com/t/b8lclXjBtm0

I am reading an important book about the psychology of trading and the mistakes we make due to it. It is clearly evident in my trading loss problem.

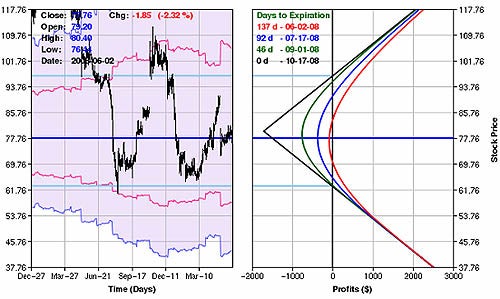

First of all one has to learn to think in probabilities and learn to think that anything is possible. When I comes AAPL and option buying, I did not realise the volatility range options can take. The closer the date the more volatile the trade becomes and the risk.

I bought the october options, which are not that volatile like the weekly. When I started last week I bought 2 contracts of weekly first with out looking at the IV, implied volatility. I guess at a price of 674, the IM must be like 35 or so but the price was 11 dollars. Then immediately after buying the stock started to like and during a huge sell off the price came down to almost 650 then closed at 655. But the market recoverd the next day.

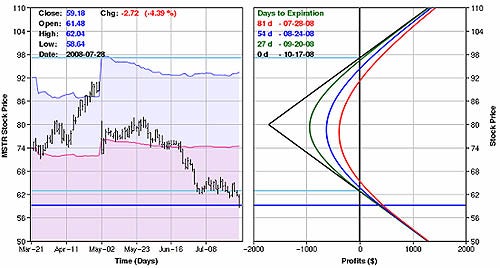

Anyway, now when I bought it, I got into the trade because I thought it was the right price and there will be sustained buying during the bull trend. But there are too many variables and any thing can happen during an intra day trade. And that is the reason one has to be very careful buying the Weekly because unless the price is right one can get into a lot of losses. So how do you know your price is right. During the consolidate phase the price varied from 650 to 670. Now one has to first

find find out the range one is willing to purchase the stock. One should also accept that this is going to happen for sure that the the stock can move in either direction. But the important point in trend analysis is that there is high probability of the stock moving up in 1 week or two weeks but not on a particular day. One should be willing to hold the stock for 2 weeks for the stock to move up. And if one is invested in options one should have the willing ness to hold a atleast 20 percent paper loss because of the volatility of options.

Anyway, I sold everything and got even because my buy points were to high and even the best range price was not meeting my options buying points. So I cut my losses and retained my capital to get into a better trade another day.

Unfortunately there was some good news about apple winning the court case and the stock now moved to 675 after market.

There are plenty of opportunities, nothing to worry. But one has to have strong guts to understand that probabilities work in 1 week or 10 days but not on a day to day basis and that is the need for holding the options or buying options 2 months to expiry. If one is buying a weekly one has to make sure that the buy point is close to the lower range of the consolidation range. Otherwise it can show 20-30 percent paper loss and one may sell it.

It is hard to buy closer to the lower point but one should try. One should understand that after a big move in the uptrend, the stock may go either direction. One has to hold the options with strong guts unless the stock is coming down. But if the stock is moving in the consolidation range one has to hold the options for at least 1 week. I know it.

Still, I made a mistake because of the wrong buy points. Any way I will try to buy better next time and learn to hold for a week or more. Unless there is a top or some problem with the uptrend. I knew the chart showed uptrend but was not strong enough to hold paper loss and bad buying points.

I

am learning from my mistakes. Since no one know for certain in short term range but one can know the trend for sure in 7 to 10 days one needs to have patience and also one needs to buy at good buying points so that the there is not too much paper loss and one can easily hold for 1 week without stress.