Try to Buy at resistance levels .THIS IS THE SAFEST WAY TO PROFITS. Wait till the stock comes closer to the moving average and only then buy it. Especially if there is a big capital involved.

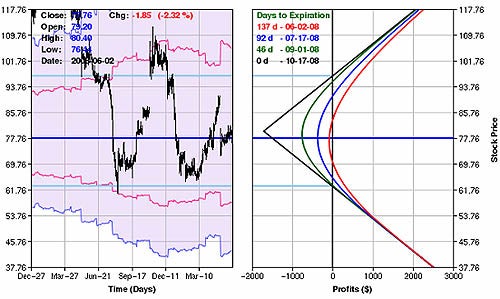

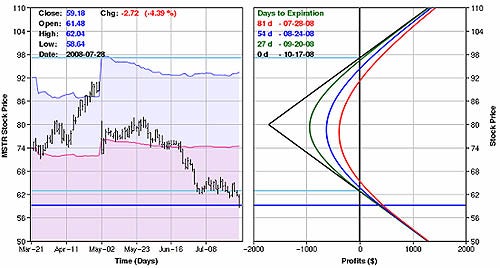

Suppose the stock is moving in a range like appl now at 260 but at that range, but if it moves to 280 and you are not sure if it is going to go up or down, then you have straddle the options.

If you do not STRADDLE, then it means that you are taking a GREAT risk and many times you lose money. If you did a STRADDLE then you would not lose any money if the market pulled back to the resistance level of 260.

So always know what the resistance level is. Try to buy at that level, with more number of calls. One can even straddle at that level too , but one can bet that on buying calls and also 1/2 number of puts.

But any level above 670 or 680, IF THE MARKET IS RANGE BOUND YOU HAVE TO STRADDLE. straddling is safest method to protect capital.

Suppose the stock is moving in a range like appl now at 260 but at that range, but if it moves to 280 and you are not sure if it is going to go up or down, then you have straddle the options.

If you do not STRADDLE, then it means that you are taking a GREAT risk and many times you lose money. If you did a STRADDLE then you would not lose any money if the market pulled back to the resistance level of 260.

So always know what the resistance level is. Try to buy at that level, with more number of calls. One can even straddle at that level too , but one can bet that on buying calls and also 1/2 number of puts.

But any level above 670 or 680, IF THE MARKET IS RANGE BOUND YOU HAVE TO STRADDLE. straddling is safest method to protect capital.